MGI Weekly round-up | 25 May 2018

Stories MGI has been tracking this week:

- Egypt to announce the winning bidder of Hamrawein coal plant

- Turkish currency tumbles

- France strikes against labour reforms

And as always, we feature content from the MGI data and analysis platform, a summary of the week’s key statistical releases, and a look to the week ahead in data. In this newsletter, we use the MGI platform (WB section) to look at the historical evolution of electricity generation in Egypt.

Egypt to announce the winning bidder of Hamrawein coal plant

Mohamed Shaker, the Egyptian electricity minister, confirmed that the announcement of the winning bidder for the 6,000 megawatts coal fired power plant for the port of Hamrawein – located on the Red Sea coast – will be made next week.

This project is part of Egypt’s plan to diversify its energy sources and upgrade the efficiency of natural gas power stations.

The lowest bid of $4.4 billion was made by a Chinese consortium that includes Shanghai Electric and Dongfang Electric, while a GE-led US consortium bid for $5.2 billion. A Japanese-Egyptian consortium that includes Mitsubishi-Hitachi Power Systems, Toyota Tsusho Corp, Orascom Construction and El Sewedy Electric bid for $6.19 billion.

The minister added that the choice of the winner will be based on the average production cost during the lifetime of the project.

Turkish currency tumbles

Turkey’s lira has lost more than 17% in 2018, with the dollar exceeding 4.9 lira on 23 May compared to 3.6 1 year ago. This makes the lira one of the worst performing emerging-currencies this year. The pressure on the lira reflected on the 10-year government bond yields– they surged to 15.29% before settling back to 14.96%.

The Turkish currency was negatively affected by the central bank's failure to tame the economy’s double-digit inflation and concerns raised by the recent comments of the country’s President, Recep Tayyip Erdoğan, that he wants greater influence over monetary policy after the snap presidential and parliamentary elections due in late June.

France strikes against labour reforms

According to reports in French media, more than 16,000 people gathered in Paris to protest against President Emmanuel Macron's labour reforms, while smaller groups marched in about 140 cities and towns across France. Nationwide, it is estimated that around 200,000 people took part in the demonstrations.

The proposed plans include the cut of 120 thousand administrative jobs and the shift of some permanent roles to a contract basis. The reforms may also include the withdrawal of certain sick leave benefits.

The number of protestors was smaller than in previous demonstrations against Macron's reforms as well as the anti-labour reform protests that took place under his predecessor François Hollande. The previous round of demonstrations in March drew around 320,000 people to the streets.

Featured content from the MGI data and analysis portal

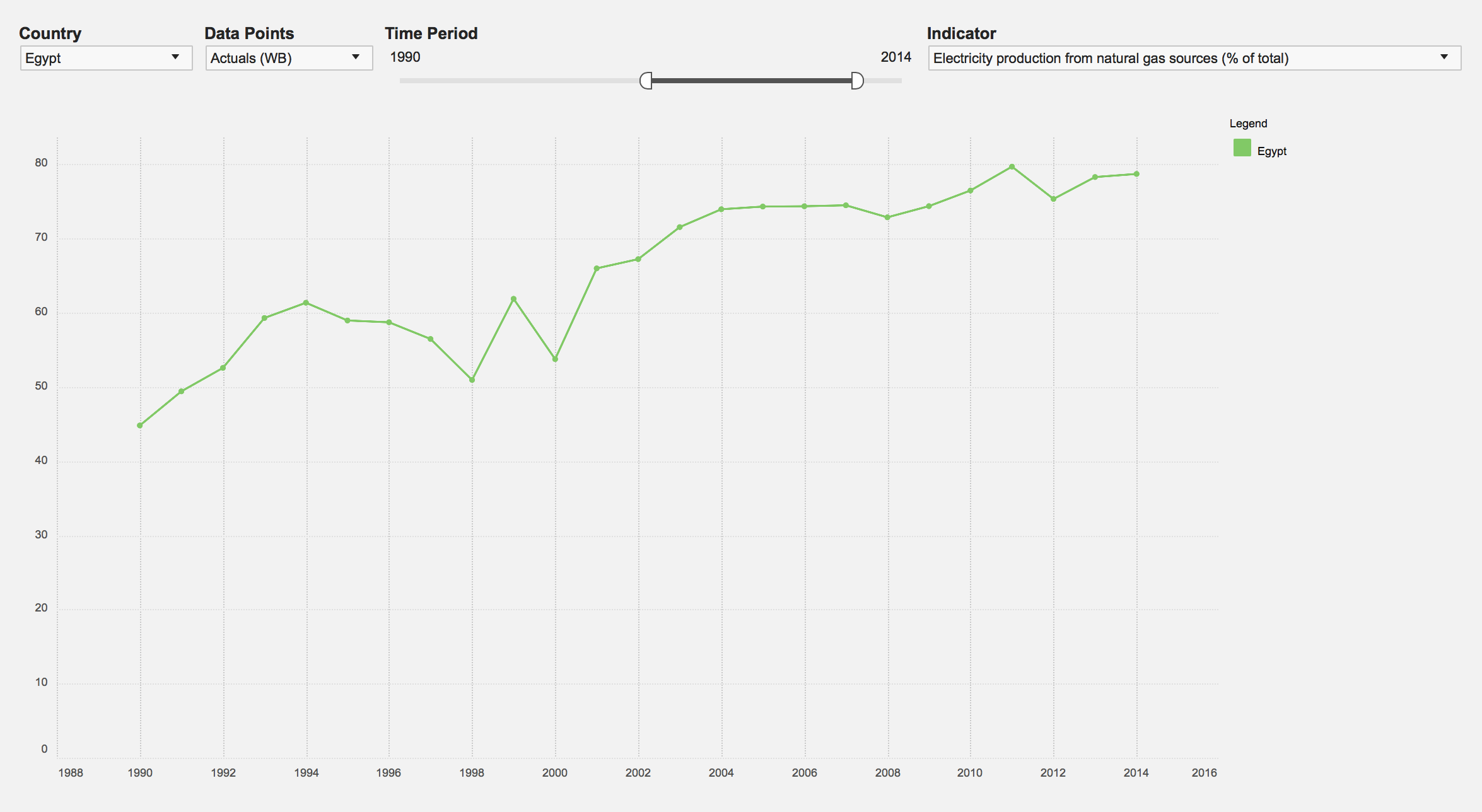

This week, we use the MGI platform (WB section) to look at the historical evolution of electricity generation in Egypt. The period under review is 1990-2014.

The chart below shows the North African country’s main source of electrical energy is natural gas. Until the late 1990s, roughly 55% of electricity was generated by natural gas power plants. This share further increased during the 2000s, as rising oil prices led electricity production to shift away from oil (see the second chart below). In 2013 - 2014, more than 78% of the electricity was generated by natural gas.

In addition, the TRADE section (TREEMAP) of the MGI platform allows users to look at Egypt’s main trading partners for imports of mineral fuels: Qatar, Saudi Arabia as well as Kuwait (see the third chart below).

The week in data

Highlights from national statistics releases tracked by MGI this week include:

- Lebanon's CPI in April 2018 increased by 5.8% YoY and 0.54% MoM.

- In April 2018, Malta's annual rate of inflation was registered at 0.84%, up from 0.82% in March 2018.

- Consumer prices in Morocco rose in April 2018 by 0.3% compared with the previous month.

Looking ahead

Next week, we expect data on business and consumer confidence, Manufacturing PMI, inflation and employment / unemployment for several Mediterranean countries,as well as real GDP figures for France, Spain, Croatia, Italy and Slovenia for 2018Q1. MGI’s complete data release schedule can be viewed at our release calendar section.

Monday 28 May,2018:

- Italy PPI for March

- France unemployment benefit claims for April

- France 3-month, 6-month and 12-month BTF auction

Tuesday 29 May, 2018:

- France consumer confidence for May

- Italy business and consumer confidence for May

- Italy 6-Month BOT auction

- Croatia IPI for April

- Slovenia employment and unemployment rate for 2018Q1

Wednesday 30 May, 2018:

- France household consumption for April

- France real GDP for 2018Q1, second estimate

- Spain harmonised and domestic inflation rate for May, preliminary estimates

- Spain retail sales for April

- Turkey economic confidence index for May

- Croatia business and consumer confidence for May

- Cyprus business and consumer confidence for May

- Cyprus IPI for March

- Greece business and consumer confidence for May

- Greece PPI for April

- Malta business and consumer confidence for May

- Malta PPI for April

- Italy 5-year and 10-year BTP auction

- Spain business confidence for May

Thursday 31 May, 2018:

- France harmonised and domestic inflation rate for May, preliminary estimates

- France PPI for April

- Spain real GDP for 2018Q1, final estimate

- Turkey balance of trade for April

- Italy employment and unemployment rate for April

- Italy harmonised and domestic inflation rate for May, preliminary estimates

- Spain current account for March

- Turkey tourist arrivals for April

- Slovenia harmonised and domestic inflation rate for May

- Slovenia retail sales for April

- Slovenia tourist arrivals for February, March and April

- Cyprus unemployment rate for April

- Greece retail sales for March

- Israel employment and unemployment rate for April

- Montenegro employment and unemployment rate (register data) for April

Friday 1 June, 2018:

- Spain tourist arrivals for April

- Turkey Manufacturing PMI (Istanbul Chamber of Industry) for May

- Spain Manufacturing PMI for May

- Italy Manufacturing PMI for May

- France Manufacturing PMI for May

- Greece Manufacturing PMI for May

- Italy real GDP for 2018Q1, final estimate

- Spain new car sales for May

- Slovenia real GDP for 2018Q1

- Croatia real GDP for 2018Q1