MGI Weekly round-up | 4 May 2018

Stories MGI has been tracking this week:

- Talk of early elections in June hurts Italian bonds

- Greeks see neighbouring Turkey as their main external threat

- Algeria plans to replace imports ban withcustoms taxes

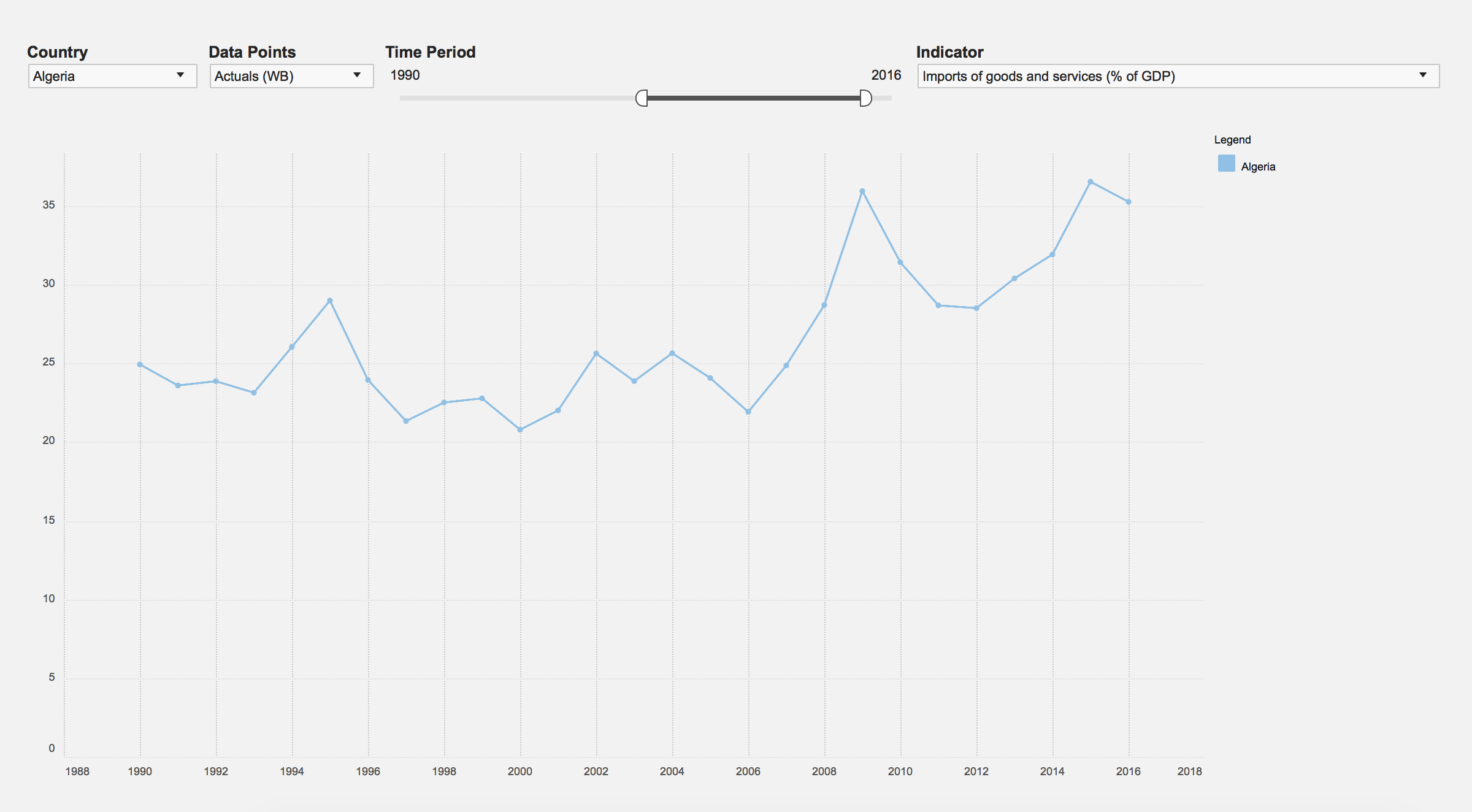

And as always, we feature content from the MGI data and analysis platform, a summary of the week’s key statistical releases, and a look to the week ahead in data. In this newsletter, we use the MGI platform (WB section) to look at the historical evolution of imports of goods and services in Algeria.

Talk of early elections in June hurts Italian bonds

Luigi Di Maio, leader of Italy’s 5-Star Movement, called on Monday for snap elections in June, saying that efforts to form a coalition government after last month’s inconclusive vote had failed. Italian stocks and bond markets came under pressure following his statement, Reuters reports.

Italy’s 10-year bond yield increased 6 basis points (bps) to 1.8%, creating a gap over German bond yields of 128 bps, compared with around 117 bps on 27 April. Although the country’s stock market was initially affected, the benchmark FTSE MIB index added 0.22% to close at 23,979 on the day.

Greeks see neighbouring Turkey as their main external threat

In a recent poll conducted in Greece by Public Issue, an opinion polling company, 87% of the respondents answered that the country’s biggest foreign policy challenge is its relationship with neighbouring Turkey. In addition, 79% said that Turkey is a threat to the country, 17% that no country is a threat to Greece, while13% consider Albania a threat, Naftemporiki reports.

The majority of the respondents believe that Greek-Turkish relations have deteriorated compared to the previous year, with Turkish challenges to Greece’s sovereignty seen as the main culprit. Interestingly, 44% of respondents believe an armed conflict between the two countries is likely in coming years, with 52% seeing such an event as unlikely. The Aegean is considered the most likely area where a hot event will occur (65% of the respondents), followed by Cyprus (17%) and the border region of Thrace (7%).

Algeria plans to replace goods import ban with customs taxes

In an attempt to raise more tax revenue and ease pressure on state finances, Algeria’s government plans to lift a ban on imports for hundreds of goods and replace it with higher customs taxes. According to Reuters, the country’s Trade Minister – Said Djellab – told a conference on 30 April that “We consider imposing additional customs duties for finished goods. This is part of our search for (a) more efficient instrument”. However, he did not reveal when the import banwill be lifted.

Algeria imposed a ban earlier this year on the import of 851 products, including cell phones, household appliances and food products, with the aim of reducing spending after a fall in energy earnings. This ban replaced a licence system imposed in 2016 to ease the country’s imports bill.

Featured content from the MGI data and analysis portal

This week, we use the MGI platform (WB section) to look at the historical evolution of imports of goods and services (% of GDP) in Algeria. The period under review is 1990-2016. As we can see in the following chart, the North African country’s imports remained close to 25% during the 1990s and the early 2000s but started to increase in 2006 and peaked at 35.9% in 2009. Although imports of goods and services declined in the following three years, they rose again and settled at roughly 36% of GDP in 2015-16.

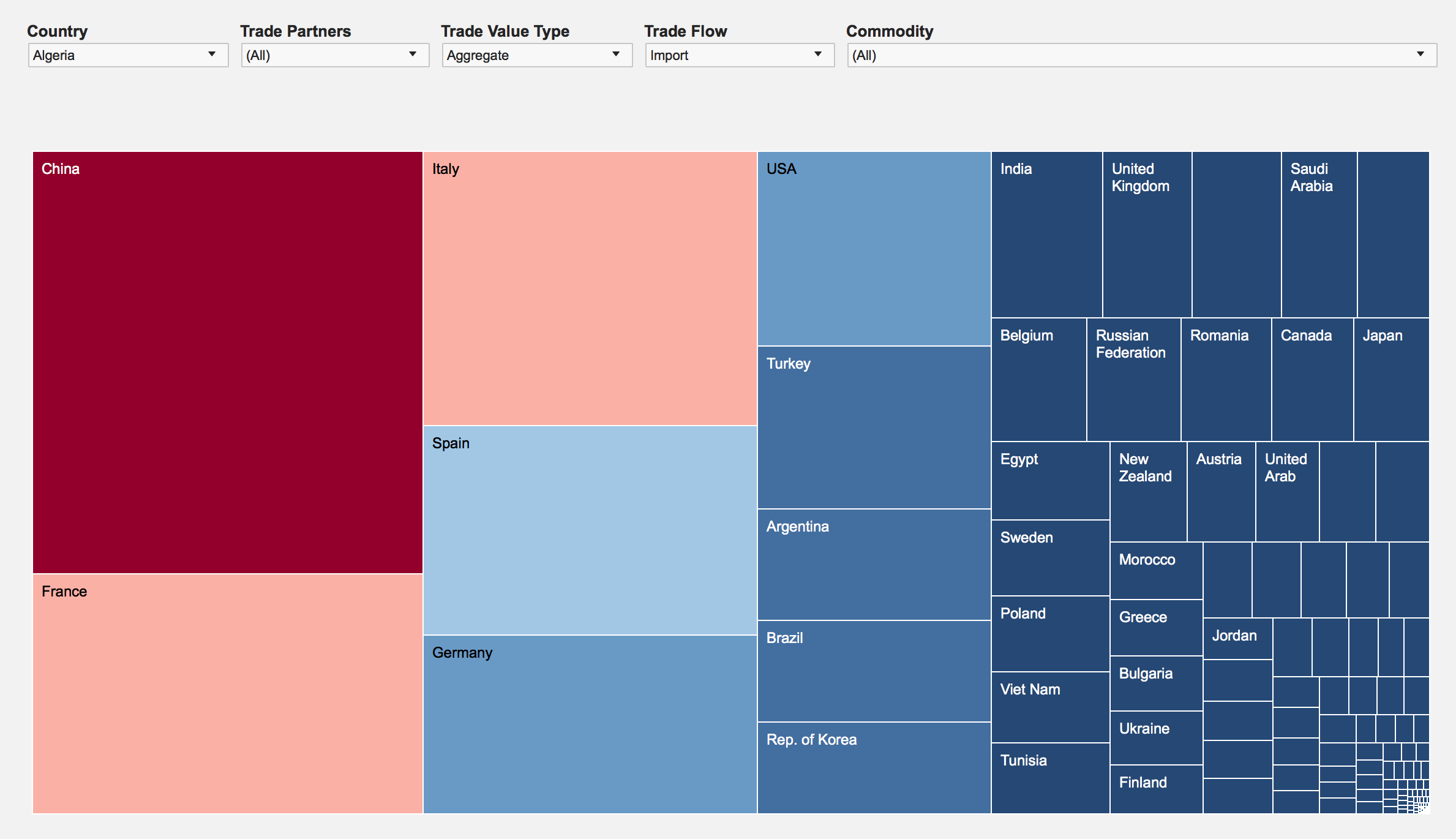

In addition, the TRADE section (TREEMAP) of the MGI platform allows users to look at Algeria’s main import partners: China, France, Italy, Spain as well as Germany (see the second chart below).

The week in data

Highlights from national statistics releases tracked by MGI this week include:

- Spain’s real GDP grew 2.9% in the 1st quarter of 2018 vs 1st quarter of 2017

- In the first quarter of 2018 Italy's GDP increased 0.3% with respect to the fourth quarter of 2017 and 1.4% in comparison with the first quarter of 2017 (preliminary estimate)

- In April 2018, Italy's CPI increased 0.1% on monthly basis and 0.5% compared with April 2017 in March 2018 (provisional data)

- Cyprus’s CPI increased 0.1% YoY and 0.6% MoM in April 2018

Looking ahead

Next week, we expect data onCPI and IPI for several Mediterranean countries,as well as unemployment rate and employment for Greece and Palestinian Territories. MGI’s complete data release schedule can be viewed at our release calendar section.

Monday 7 May, 2018:

- Israel foreign exchange reserves for April

- France 3-month, 6-month and 12-month BTF auction

Tuesday 8 May, 2018:

- Albania CPI for April

- Malta IPI for March

- Palestinian Territories unemployment rate and employment for 2018Q1

- Spain 6-month and 12-month Letras auction

- Turkey treasury cash balance for April

Wednesday 9 May, 2018:

- France IPI for March

- Italy retail sales for March

- Israel tourist arrivals for April

- Spain IPI for March

Thursday 10 May, 2018:

- Egypt core Inflation rate for April

- Israel consumer confidence for April

- Italy IPI for March

- Italy 12-month BOT auction

- Greece unemployment rate and employment for February

- Greece IPI for March and CPI for April

- Montenegro CPI for April and March

- Slovenia IPI for March

Friday 11 May, 2018:

- Italy 3-year, 7- year and 30-year BTP auction

- Spain harmonised and domestic inflation rate for April, final estimates